Marking milestones and making memories

Editor's note: Jim Tincher is founder and mapper-in-chief at Heart of the Customer, a Minneapolis research firm.

It’s no secret that the e-commerce share of total retail sales grows larger every year. It currently hovers around the 10 percent mark on its inexorable, upward trajectory.1 Brands that established their distribution channels long before the digital age ignore Amazon and other e-tailers at their peril. As H.G. Wells put it: Adapt or perish.

But doom-and-gloom predictions for brick-and-mortar stores also miss the mark. For one thing, that 10 percent figure conceals a wide disparity across sectors and products. In the U.S., you can still count on one hand the percentage of groceries sold online, while the figure for books and music is around 50 percent.2 The skewed picture this paints of the retail landscape makes it all too easy for companies to be led astray and waste already limited marketing resources tilting at windmills to recapture lost market share through often misunderstood – and sometimes overestimated – digital channels. The in-person shopping experience is not on its deathbed just yet.

In fact, the key role emotions play in purchasing decisions can work in favor of in-person experiences, as Avery Products Corp. recently discovered when a division of the company decided to map the back-to-school supplies shopping journey.

Over the past 75-plus years, Avery, one of the world’s leading manufacturers of home, work and school supplies, has built a reputation for quality and durability. The company’s school supplies product line includes binders, dividers, tabs, sheet protectors, folders, markers, highlighters and glue sticks. Sales in Avery’s school supplies products surge every year in the third quarter, as families make their back-to-school purchases.

Avery school supplies are sold through online channels – including, of course, Amazon – as well as big-box and specialty stores. But the company was feeling the three-pronged impact of technological advances that have changed or reduced the use of its traditional product lines, declining store sales and increasing pressure from low-quality, low-priced private-label brands – such as Target’s Up&Up products – which hog premium shelf space and woo price-conscious consumers. The number of U.S. households with school-age children has been decreasing in recent years, which only exacerbates the situation.3

There’s still a robust market for Avery products; the firm just needed to discover new and better ways to engage with consumers. In recent years, it’s even made significant inroads with Amazon, through a partnership with influencer and designer Amy Tangerine on a fashion collection of products targeted at teenage girls. Avery focused on increasing its online presence to offset the decline in retail store sales and the products have proven to be wildly popular. But it needed to do more.

Require a better understanding

The company recognized that responding to these new market challenges would require a better understanding of how consumers make decisions about back-to-school supplies, finding out whether parents’ decision-making varied significantly by the age of their children, determining how consumers feel about branded vs. store products and identifying the best ways and times to communicate with parents to influence their decisions more effectively.

That’s where journey-mapping came in.

Since emotions drive buying habits, it’s more important than ever to determine what consumers are thinking and feeling during the shopping journey, in order to identify the trouble spots in the journey that are causing buyers friction and the moments of truth that have a disproportionate impact how positively or negatively they view the journey overall. That’s why journey-mapping has become a foundation of many effective customer experience programs. When done properly, it unlocks the knowledge essential to developing an effective strategy for improving the customer experience and boosting brand loyalty. So Avery set about harnessing the power of this valuable tool.

“I’m sure a lot of other brands will relate, as we see more online space pressure, Amazon taking over and pushing down prices,” says Consumer Insights Manager Melody Miyaji, a core member of the Avery mapping team for the project. “Journey-mapping is a big up-front investment but it needs to be done, because in the long run, you have to be very strategic and careful spending what you have.”

Five essential questions

Avery contracted with Heart of the Customer, my journey-mapping consulting firm, to shepherd them through the process. Our team started with the three most important factors in successful journey-mapping: involving a broad, cross-functional team; embedding the voice of the customer in decision making by involving consumers in the process; and selecting the right journey.

To ensure best practices were followed, we began by asking five essential questions:

- What is the business problem or opportunity mapping is meant to address?

- What’s the right journey to map?

- Who’s the right customer to map?

- What’s the right approach and methodology to use?

- Who’s on the right team?

“Going through the process was key. It’s critical for anyone thinking about journey-mapping,” Miyaji says.

The first steps in journey-mapping accomplish more than just information-gathering. They are designed to generate buy-in and excitement in order to engage employees and, most importantly, to align the key stakeholders within the company who can take ownership and eventually green-light the programs that will transform the company’s decision-making to make it more customer focused.

The project kicked off in May 2018, in order to be ready for the back-to-school shopping season, which was thought to begin in June. (More on that in a moment.) We met with key stakeholders for a hypothesis-mapping workshop to review ideas in order to frame the approach and determine the best methodology for engaging parents across the entire journey, which lasts into the beginning of the new school year in September.

Avery was thrilled with the outcome of that effort. It ended up with a framework from the workshop that allowed it to fill in the gaps and validate assumptions through surveys. “The design was genius,” Miyaji says, “an out-of-box approach that really worked.” It combined digital ethnography that followed parents while they shopped with surveys that targeted specific parts of the journey. Using both qualitative and quantitative research resulted in a rich representation of the voice of the customer.

Data was gathered through forums, quick polls, diary studies, journals, scrapbooks and surveys, with more than 350 participants contributing to the community. This longitudinal approach allowed Avery to see how parents’ mind-sets, attitudes and motivations changed over the course of the journey. “Following consumers over time was different than what we’d done in the past,” Miyaji says. “A typical face-to-face interview is on one day but following shoppers over months? That was really interesting and unique.

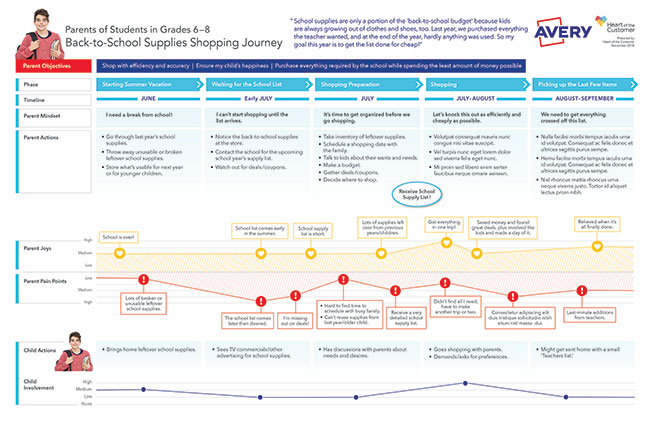

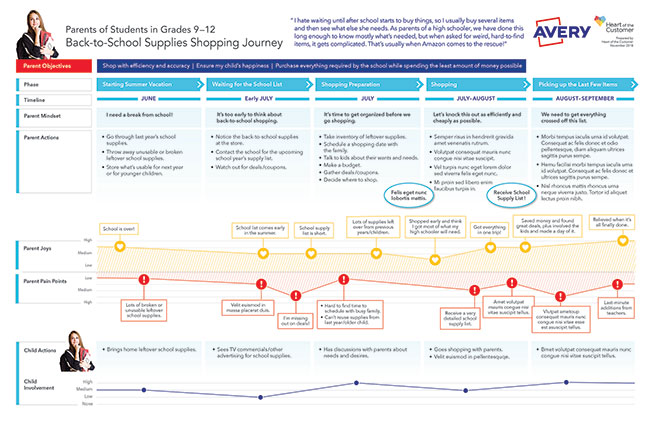

“There were trade-offs between talking with someone in their home once and following people over time,” Miyaji says. “In place of deep but narrow perceptions, we were able to look at how people rated different features over time and how the importance of those features changed.” For example, when asked in June, while planning their shopping, parents rated brand as most important; convenience came in a distant fourth. (Involving the children and in-store pricing were between the two.) Fast-forward to September, with the new school year already in full swing and the importance of those features flipped. Stressed and anxious parents eager to find the remaining items on their lists weren’t picky, they just wanted to be done.

“It was disappointing for us to see but they were scrambling,” Miyaji says. “It was enlightening to see the impact of external factors and the emotional feelings that came out. But that’s what’s great about journey-mapping – it allowed us to look at that shift and their purchasing experience over time.”

The process of identifying personas was a little unusual. Typically, participants would be sorted based on their behaviors or other experiential attributes. But in this case, the segments were determined based on the age of the subjects’ children. It was important to Avery to determine whether parents’ buying decisions varied based on the grades their kids were entering, especially since high school students make decisions primarily on their own.

Ultimately, journey maps were created for three personas, representing parents of elementary-aged children, middle schoolers and high schoolers.

Misjudge a business problem

Overall, the insights revealed by the mapping process did not surprise the team. However, they did show how initial internal hypotheses can misjudge a business problem, giving more weight to a perceived issue than it merits and missing other opportunities entirely. That’s why involving actual consumers is so important in journey-mapping.

First and foremost, Avery discovered that the shopping journey didn’t begin organically each June after a brief break at the end of the school year. The trigger for the journey was the schools’ release of their supply lists, which typically didn’t occur until early to mid-July. These grade-specific lists are the real drivers of the journey at every level, spurring parents of children in all of the segments into action. “That was a big aha moment for us,” Miyaji says. “Because we knew the lists were important but didn’t realize how they dominate everything.”

The second key finding was that, despite the expense and hassle of shopping for back-to-school supplies, parents in the younger age segments genuinely valued the bonding “quality time” it entailed. Parents enjoyed “making a day of it,” stopping for lunch or ice cream, indulging kids by allowing them to select a special item and spending time together sharing an activity.

Essentially, what we found was that traditional retail still matters. And the emotional connection with that type of activity probably applies to other areas in back-to-school shopping as well.

As the two discoveries above demonstrate, Avery also found, to its relief, that there weren’t any game-changing differences between the consumer segments.

Address the insights

With the research and mapping completed, we launched into the third phase of our journey-mapping protocol, leading the cross-functional Avery team through an action-planning workshop designed to develop both short- and long-term programs to address the insights gleaned from the journey maps. The workshop is designed to generate dozens of ideas, sorted into two types, with teams voting on those they believe should move forward and be further developed. “Strategic ideas” focus on long-view direction, while “quick wins” provide instant gratification, boosting enthusiasm and engagement within the team with actions that have an immediate impact. “Since not all of the ideas generated are going to take a ton of resources, we’re armed with ideas we can implement right away,” Miyaji says.

Our three-phase mapping process – discovery, customer immersion and action – allowed Avery to focus its efforts on realizing the greatest return on its investment for multiple business outcomes and ensures that the voice of Avery’s consumers will be embedded in decision-making going forward.

Having a core team was critical to the success of the project. The core Avery team included Miyaji, Senior Product Manager Sheila Vega and the project sponsor Marketing Director Laura Cruz. A broader cross-functional team, spanning multiple departments, was also involved every step of the way. “There was a time commitment, but it was spread over months,” Miyaji says, “including just making sure people were aware of the project and kept it top-of-mind and getting leadership on board supporting the research. When it came time for the action-planning workshop, the hypothesis-mapping workshop was still fresh in people’s minds even though it had taken place months before.

“Avery wants to do journey-mapping for all of our business categories now and the success of this experience moves that along,” Miyaji says. “And it’s given other teams confidence. People are saying, ‘I want to do this!’ and ‘How can I do that?’ And now with our experience with the process, we can advise them on administering the project.”